In Summary

- The size of United Capital Asset Management Limited’s fund as of 21 March 2025 is $131.13 million.

- More than 80% of the total comes from five countries: South Africa, Egypt, Morocco, Nigeria, and Kenya.

- Eurobonds issued by African governments have been consistently oversubscribed, with some instances exceeding 5 times.

- The African Development Bank (AfDB) has issued a $2 billion 5-year social benchmark bond.

Deep Dive!!

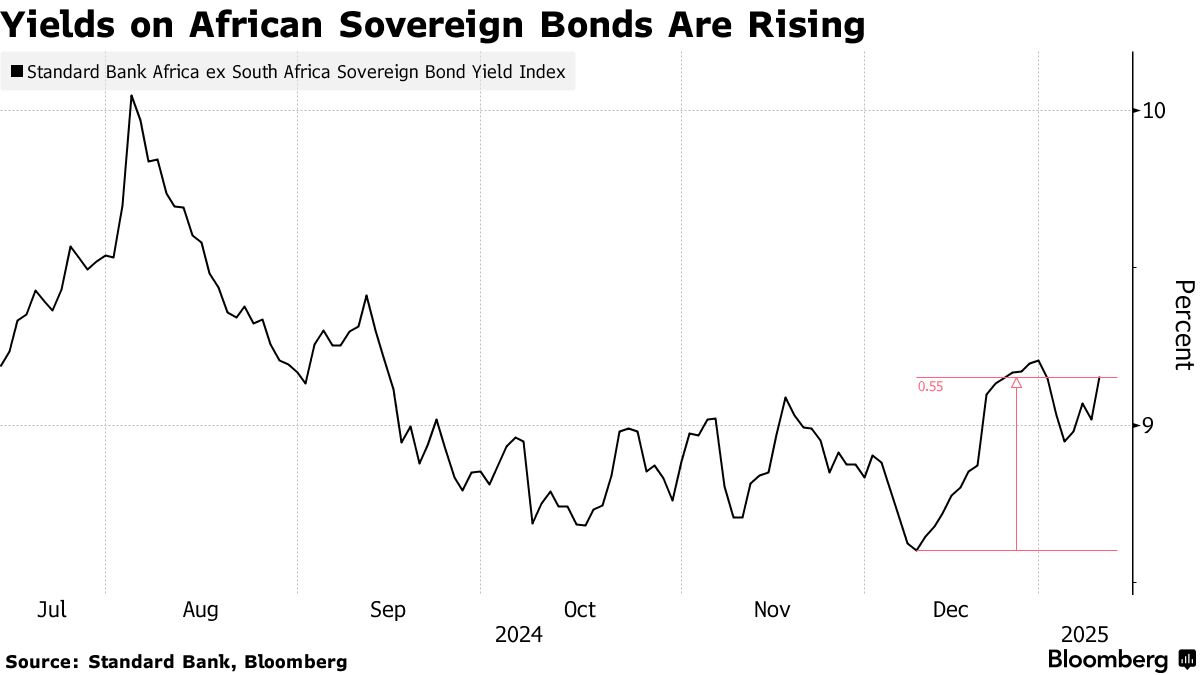

Africa’s bond markets have increasingly become a focal point for global fixed-income investors seeking diversification and higher yields. The worth of Global Fixed Income Investors in Africa is significant, with various instruments and funds contributing to the overall value.

For example, United Capital Asset Management Limited has a fund with a size of ₦212,987.63 million as of March 21, 2025. Additionally, the African Development Bank (AfDB) has issued a $2 billion 5-year social benchmark bond, demonstrating investor confidence in the bank’s creditworthiness, according to an AfDB press release.

Global fixed-income investors have shown significant interest in African markets, particularly through Eurobond issuances, with demand often exceeding supply. This interest is driven by a combination of factors, including Africa’s strong growth potential, increasing investor appetite, and the need for diversification. However, it’s also important to note that high yields and the potential for oversubscription can be linked to a country’s debt levels and macroeconomic stability.

In 2025, several countries are leading the charge in attracting this investment. This article examines the top 10 African nations drawing significant attention from global fixed-income investors, highlighting the factors contributing to their appeal.

Here are the Top 10 Countries Attracting Global Fixed Income Investors to Africa’s Bond Markets in 2025.

10. Zambia: Despite facing debt restructuring challenges, Zambia’s rich natural resources and efforts to implement economic reforms have the potential to attract fixed-income investors. The government’s engagement with international financial institutions and commitment to fiscal discipline are steps toward restoring investor confidence. However, careful monitoring of the debt situation is essential for prospective investors.

9. Senegal: Senegal’s commitment to economic reforms and infrastructure projects has garnered attention from global investors. The government’s proactive approach to issuing sovereign bonds to finance development initiatives has been well-received. Senegal’s stable democracy and strategic location contribute to its investment attractiveness.

8. Côte d’Ivoire: Côte d’Ivoire’s robust economic performance and stable political climate have made it an attractive destination for fixed-income investments. The country’s efforts to improve its financial infrastructure and regulatory environment have enhanced investor confidence. Côte d’Ivoire’s role as a regional hub in West Africa further adds to its appeal.

7. Ethiopia: Ethiopia’s rapid economic growth and large population present significant potential for bond investors. The government’s focus on industrialization and infrastructure development has led to increased issuance of government securities. While challenges remain, ongoing reforms aimed at liberalizing the economy are promising for future investment inflows.

6. Morocco: Morocco’s strategic reforms in the financial sector and its efforts to integrate into the global economy have strengthened its bond market. The country’s stable political environment and sound economic policies have attracted a steady flow of foreign investment. Morocco’s emphasis on renewable energy and infrastructure development offers additional avenues for investment.

5. Ghana: Ghana’s political stability and consistent economic growth have made it a favorable destination for fixed-income investors. The government’s prudent fiscal policies and efforts to improve the business climate have contributed to a robust bond market. Ghana’s focus on sectors like energy and agriculture provides diverse investment opportunities.

4. Kenya: Kenya’s bond market benefits from a diversified economy and a proactive approach to financial innovation. The government’s issuance of infrastructure bonds to fund development projects has attracted both domestic and international investors. Kenya’s commitment to maintaining a stable macroeconomic environment further enhances its attractiveness.

3. Egypt: Egypt’s strategic location and ongoing economic reforms have positioned it as a key destination for bond investors. The government’s efforts to stabilize the macroeconomic environment, coupled with initiatives to attract foreign direct investment, have enhanced the appeal of Egyptian bonds. Additionally, the country’s participation in international financial markets through instruments like Eurobonds has expanded its investor base.

2. Nigeria: Nigeria’s bond market has shown remarkable growth, driven by economic reforms aimed at enhancing transparency and investor confidence. The government’s commitment to infrastructure development and diversification away from oil dependency has further bolstered the market’s attractiveness. With a young and burgeoning population, Nigeria offers a dynamic environment for fixed-income investments.

1. South Africa: As Africa’s most sophisticated financial market, South Africa continues to be a magnet for fixed-income investments. The country’s well-established bond market, coupled with a robust regulatory framework, offers investors a blend of stability and attractive yields. Despite facing challenges such as currency volatility influenced by global trade tensions and domestic political dynamics, South Africa’s bond market remains resilient. The Public Investment Corporation (PIC), managing assets worth approximately ZAR 2.693 trillion (USD 142 billion) as of March 2024, plays a pivotal role in the market’s stability.

Conclusion

The African bond market landscape in 2025 reflects a continent in transition, with several nations implementing reforms and policies to attract global fixed-income investors. While opportunities abound, investors must navigate challenges such as currency volatility, political dynamics, and global economic shifts. Engaging with reputable financial institutions and staying informed about local market conditions are crucial steps for those looking to invest in Africa’s burgeoning bond markets.