Down an alley off Kukawa Street in Lagos Island, across from a building abandoned mid-construction, Paulo Communications does a brisk trade. On an average day, dozens of customers walk past fried food and fresh fruit stands to visit his street-side shop and top up their mobile phones or pay their monthly satellite TV bills.

The shop’s biggest business is mobile transactions. It completes dozens of withdrawals, deposits and payments for customers every day, using half a dozen different systems offered by telecommunications giants, big banks and the fintech companies that have made Lagos — Nigeria’s commercial capital — Africa’s hottest start-up scene, accounting for roughly a fifth of the continent’s total venture capital funding in 2020.

“There are at least 20 bank branches near here, but still they come to me,” says proprietor Paulo Umunnabuike, showing off an array of point-of-sale machines from each of the companies that he uses. “At the bank, you wait in line — here, it is much faster.”

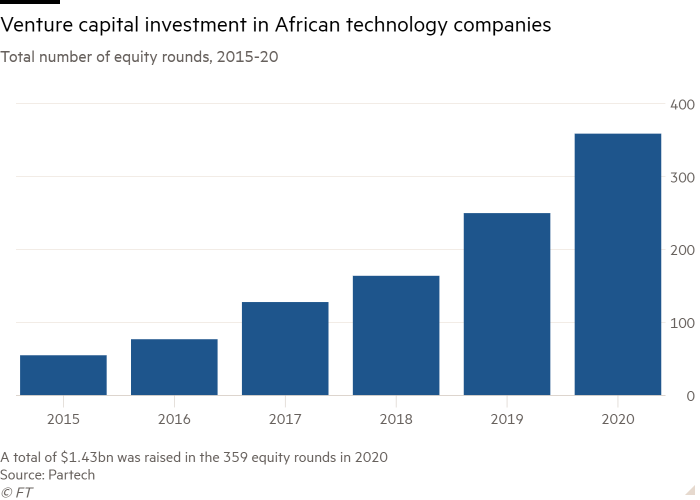

After years in which Nairobi, the Kenyan capital, led Africa’s tech revolution, momentum has shifted to west Africa and to Lagos, which has attracted more than $1bn in venture capital in the past two years from Silicon Valley, China and elsewhere. In 2020, as the coronavirus pandemic hit tech fundraising, Nigerian companies raised $307m in venture funding, a fifth of Africa’s total, according to Partech, a venture fund, in its annual report on technology in Africa. Nearly 40 per cent went to the fintech sector.

The swell in fintech in Nigeria has come even as critics argue the government has taken a heavy-handed, sometimes antagonistic approach to the nascent sector, and as internet connectivity rapidly expands across the continent, in part thanks to high-speed subsea cables backed by the likes of Google and Facebook. The “last billion” — as the population of people least connected to the internet are known — are coming online and many of them live in Nigeria, home to one in seven Africans on the continent.

“Even if I wasn’t Nigerian, I would probably be here,” says Tayo Oviosu, founder of Paga, a payments company that was Umunnabuike’s first fintech partner and processed $2.3bn in transactions for 17m users last year. “The opportunity of Nigeria . . . is really profound — there are so many things to solve.”

The sheer size of Nigeria — 200m people, including roughly 60m adults who lack bank accounts — has driven explosive fintech growth. Despite the economic woes of an economy that for decades has been too reliant on oil, the country makes up nearly a fifth of Africa’s output of roughly $2.6tn.

While small by western standards, the money pouring into Lagos in recent years is massive for the continent. It includes roughly $400m in a single week in November 2019, when Sequoia Capital China, SoftBank Ventures Asia and Visa all invested in Nigeria-based start-ups.

Much of the investment has gone to companies that provide network or payments services, connecting businesses to customers or to each other or banks and global payments firms like Visa and Mastercard.

Two of Africa’s three $1bn start-ups are Nigeria-based, while the third, Fawry, is Egyptian. The valuation of Flutterwave, a payments company, topped $1bn after a $100m investment round last year, and Interswitch, Nigeria’s first major payments processing company, hit that mark with a $200m investment from Visa.

Another success story is Paystack, which was acquired for $200m last October by Stripe, the payments group that is the world’s highest-valued venture-backed company. There are dozens of smaller firms working in various niches of the financial system, from small-business microlending to cryptocurrency to vehicle-financing start-ups like Moove, which raised $23m from European and US funds in August.

“Nigeria for us is arguably the most important piece of the African jigsaw,” says Babs Ogundeyi, founder of Kuda Bank, a digital-first bank, which in August announced that it had raised $55m at a $500m valuation. “From an African context, historically Nigeria has been the most progressive and forward-thinking country on the continent . . . If you’re trying to come to Africa and you’re not in Nigeria, you haven’t really started.”

Twitter spat sparks regulation fears

The potential rewards in Nigeria are tantalising. Raghunath Mandava, chief executive of Airtel Africa, estimates that the country’s mobile money market alone could be worth as much as $4bn based on the company’s experience in Kenya, where annual revenues for mobile money operators combined are around 1 per cent of that country’s gross domestic product.

The country’s demographics help, with 70 per cent of Nigerians aged under 30, a cohort that is increasingly online and mobile-first. Yet the informal economy represents more than half of GDP and 95 per cent of transactions in Nigeria are still done in cash — a fact reflected in the sheer size of bank branches, which must have ample room to store hard currency. That means most branches are clustered in major cities. Even Lagos, a city of 20m people with a GDP bigger than Kenya or Ghana, remains relatively underserved.

“We haven’t even scratched the surface,” says Tomilola Majekodunmi, founder of Bankly, a start-up aiming to provide banking services to the tens of millions of Nigerians working in the informal sector. “[Traditional] banks have done what they have done . . . but we still have 100m [people] to go. And we’re not even talking about the bottom of the pyramid, who need economic inclusion before they even need financial inclusion.”

Still, the challenges in Nigeria are myriad. The electricity grid is barely functional, dribbling out as much power for the whole country as would be used in a single large western city. That means start-ups that want to run 24-hour customer service must have multiple back-up generators running on costly diesel fuel.

There are more and more talented engineers in Lagos, but not enough to support the growing number of companies, and many are scooped up by international tech firms or the bigger local start-ups. The government also poses a problem: it is generally suspicious of new money.

“People who have traditionally been successful in Nigeria have had a ‘godfather’, and so when people see you, they try to size you up and figure out who’s behind you,” says the founder of one start-up. “There is an expectation that there is some [politician] back there making money, and so it’s been different for them to see all of the start-ups who don’t have a ‘godfather’, and are actually doing good stuff.”

Weekly newsletter

For the latest news and views on fintech from the FT’s network of correspondents around the world, sign up to our weekly newsletter #fintechFT

Sign up here with one click

The Nigerian government’s byzantine structure, endemic corruption and penchant for free speech crackdowns is widely thought to have led to Twitter’s decision in April to place its first Africa office in much-smaller Ghana, even as many of its job postings described positions focused on Nigeria, a far bigger market. Two months after that decision, the Nigerian government banned the social media platform after it removed a post from President Muhammadu Buhari that threatened to punish regional secessionists. As they grow bigger, some Nigerian start-ups end up domiciling in the west, which removes them from the capricious domestic regulatory environment and makes it easier to raise funds from western investors.

The economic picture, meanwhile, is dire. The Nigerian economy has crumbled over the past half a decade, which included two recessions brought on by oil price crashes. Annual GDP growth of 1 or 2 per cent, which lags the explosive expansion in population, has become routine. Inflation has soared to record highs, while foreign direct investment — outside the tech sector — has plummeted. Roughly 90m Nigerians live in extreme poverty — defined as surviving on less than $1.90 a day — more than in India, a country with seven times as many people. A third of Nigerians are unemployed, with another fifth underemployed.

For young people, the combined unemployment and underemployment rate is roughly two-thirds. For those in work, the current minimum wage is N30,000 a month, or about $3 a day. It will be hard to build the next generation of bank customers on such little income, which throws into question the astronomical valuations being attached to the country’s fintechs.

“There may be 200m people, but there’s an addressable market of 2m — so there’s a lot of froth,” says one sceptical senior banker in Lagos. “How many people can afford to pay back these loans [for cars or small businesses]? Not many . . . How many people make more than $50,000 [a year] in Nigeria? Not very many.”